However, when it comes to dollar-bond defaults, out-of-court restructurings are common and allow creditors some leeway to strike a deal different to the one agreed with domestic creditors and on different timelines. What Are The Chances Of Offshore Bondholders Recovering Their Money?Ĭhinese restructurings are often complicated and not easily standardised, according to S&P.

“The hand of the government and authorities is never far away.” “Evergrande is almost like a quasi-sovereign debt restructuring in that the significant stakeholders and the authorities are no doubt dictating what should be done, although with the sponsor still in place,” he said. However, the nature of the issuers and the invisible hand of authorities can prove a stumbling block, said Karl Clowry, restructuring partner at Addleshaw Goddard in London. “Instead of giving a judgment requiring a payment directly to a bunch of foreign creditors, the Chinese court would just be upholding a promise that a mainland parent gave to its subsidiary, which it failed to perform on.” Such a move could improve the optics for the Chinese court, Billington said. This would essentially mean the creditors take over the SPV that issued the bonds through a liquidator, who then would pursue the vehicle’s claims against the Chinese parent company. “Instead of enforcing the keepwell itself, the bondholders could put the offshore issuer company into liquidation or other insolvency process,” Billington said.

Given how entrenched Evergrande is in China’s economy, some analysts voiced doubts over how enthusiastic Chinese courts would be to facilitate a payout to foreign creditors, potentially to the detriment of domestic ones.ĭavid Billington, a restructuring partner at Cleary Gottlieb Steen & Hamilton LLP, said creditors might have some other options. But it notes that a decision could have been different if proceedings had been contested.

This decision was upheld last November on the grounds that enforcement would not be contrary to public interest, law firm Ashurst says. Test cases for this structure have been few and far between.Ĭhow points to the case of Peking University Founder Group Co Ltd, where court-appointed administrators ruled last year that they would not recognise the keepwell deeds of the group’s defaulted offshore bonds.īut in a separate case, an offshore bondholder in CEFC Shanghai International Group Limited (CEFC), who filed a claim in Hong Kong against the company for breach of the keepwell deed, secured a default judgment in its favour. “The fundamental question in front of investors is whether the keepwell agreement is enforceable and what difference that may make in the recovery process should the group default,” said Matthew Chow at S&P Global Ratings. Is The Keepwell Structure Legally Enforceable?Ĭhinese courts are widely seen to have broad discretion to refuse to enforce a keepwell, based on public interest. The keepwell structure emerged in 2012-2013, according to Fitch, which cited data estimating that in 2020 more than 16%, or nearly $100 billion, of outstanding offshore bonds issued by Chinese corporates contained keepwell structures.

The way many market participants worked around the lack of a guarantee was by using keepwell deeds – an undertaking to bondholders, and the offshore SPV which issues the debt, that the parent will make sure the SPV maintains a positive net worth and remains solvent. To work around this, offshore corporate bonds, in many cases, are issued by Special Purpose Vehicles (SPVs) and feature a so-called keepwell structure.Īlso on AF: World Outsourcing Hub India Battles Record Talent Squeeze

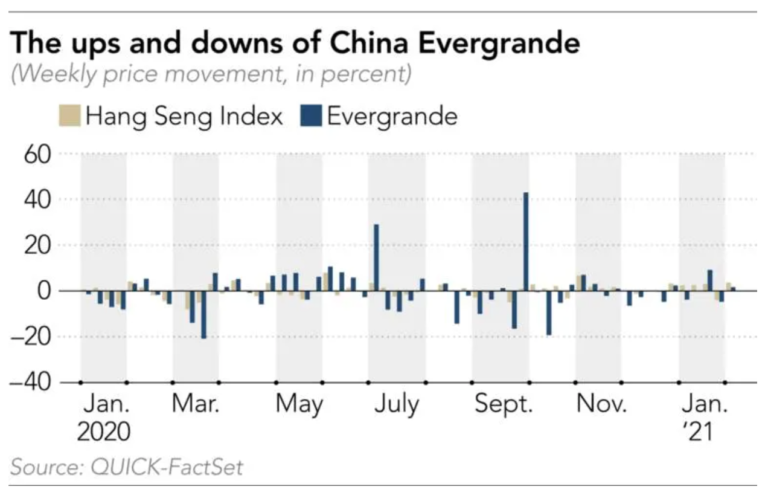

Evergrande defaults registration#

Here are the factors at play as offshore investors, with some $20 billion of Evergrande debt outstanding, gear up to deal with the potential fallout from what could become China’s biggest ever corporate default:Īre Evergrande’s Offshore Bonds Guaranteed?Ĭhinese legal rules prevent mainland-incorporated parent companies from guaranteeing their subsidiaries’ offshore debt without going through a registration and approval process. With China Evergrande Group’s default deadline drawing closer, offshore bond investors in the property developer are pondering their legal options if they’re to protect their investments.

0 kommentar(er)

0 kommentar(er)